UK property blog by National Homebuyers

The UK property market is a fascinating place. Here you’ll find our thoughts on what’s happening in the industry, why and how people are buying properties and what gives you the best chance of selling your home.

Selling a property in probate?

27 May, 2022

A probate process needs to be completed before you can inherit a house and subsequently sell it. The process of probate proves your ownership and gives you legal rights to make decisions on the property. There are more complications when selling around the probate process and it may seem very daunting. Secure the House Insure […]

Continue reading >

Selling a property after a break-up?

Some of our clients are young couples who could afford their mortgage costs when it was just them, but now they’ve started a family and the cost of taking care of their child has stretched their finances. Other couples have bought together but have broken up since. There are many ways to settle the large […]

Continue reading >

Buying a house for your child to rent

7 April, 2022

It’s never been trickier for young people to invest in their first home. Recent growth in first-time buyers has come with an average £53,935 deposit and an age of 32, according to recent figures from Halifax. So, if you’re a parent, have you considered buying a house for your child to rent? Around one third […]

Continue reading >

What is a maisonette?

When you’re buying or selling a home, it’s easy to get tripped up by seemingly common words and phrases. Especially if the meaning is changed in different countries. So what is a maisonette? And how is it different from a house or flat? They’re most often found in larger cities, including London. And can vary […]

Continue reading >

Can you sell a house without a gas safety certificate?

If buying a house is largely about location, it can feel that selling is mainly documentation. But while some is required by law, other paperwork will just help you to get a better price. So, can you sell a house without a gas safety certificate? And what about a boiler certificate? What’s a gas […]

Continue reading >

What are Title Deeds, and why are they important?

6 December, 2021

They’re always referenced whenever people talk about buying or selling a house. But what are title deeds, and why are they important? And when was the last time you checked the deeds for your own property? Estate agents and other professionals in the homebuying process will often assume you know and understand all of the […]

Continue reading >

How much will solicitor’s fees cost when selling your house?

Whether you’re setting out the expected price for a property listing, or considering which offer to accept, it’s important to understand all of the costs involved. Or you might find yourself walking away with substantially less than you expected. So how much will solicitor’s fees cost when selling your house? There’s no legal requirement to […]

Continue reading >

How long are you liable after selling your house?

You might imagine that when you’ve sold your property, it’s the end of the process. And from that point on, any problems will be the responsibility of the new owner. But that’s not always the case, so how long are you liable after selling your house? And can you avoid any problems cropping up years […]

Continue reading >

How soon can you sell a house after buying it?

9 November, 2021

Whether you’re planning to renovate and flip a property, your situation has changed due to unemployment or divorce, or you’ve changed your mind after completion for any reason, you’ll want to know how soon can you sell a house after buying it. For UK home buyers, the answer will vary depending on how you made […]

Continue reading >

What’s happened to house prices after Brexit?

Whatever your political views on the five years since the UK Referendum, it’s important to understand what’s happened to house prices after Brexit whether you’re considering buying or selling a property. But planning for the future has been made much harder due to the impact of the coronavirus pandemic. The switch to working from home […]

Continue reading >

How long do homebuyer’s reports and house surveys take to complete?

11 October, 2021

If you’re buying a house then a homebuyer’s report or house survey is a valuable part of the process, as it could reveal serious issues with the property. It’s important to know how long homebuyer’s reports and house surveys take to complete, as you need to know the findings before contracts are exchanged. After receiving […]

Continue reading >

Can you get a mortgage as a student?

If you’re in higher education and looking to invest in your future, buying a property might be a good option. Especially if you’re already tired of rental accommodation. But can you get a mortgage as a student? The short answer is that’s it’s possible, although the criteria to meet will be more difficult than for […]

Continue reading >

How to check for Restrictive Covenants on your property

Whether you own a property or are thinking about buying a new home, it’s important to know if you’ll face any rules or restrictions when it comes to alterations, usage, or even having pets or a washing line. And while some obligations might not impact you or prove more than a minor inconvenience, others can […]

Continue reading >

Selling a house after the death of parent

2 September, 2021

The loss of a family member is never easy, whatever the circumstances. The grief from a bereavement can make practical issues, such as selling a house after the death of a parent, even more stressful and daunting. Especially if it’s the childhood home, or if there are multiple beneficiaries from any will. Selling the property […]

Continue reading >

What do I have to disclose when selling a house?

Attracting offers for your property can be time-consuming and stressful. Advertising your home, preparing everything for viewings, and answering questions from potential buyers can be challenging. And you will probably wonder exactly what do I have to disclose when selling a house? Buyers have always carried the most responsibility for making sure they’re investing in […]

Continue reading >

What is Chancel Repair Liability?

If you’re buying or selling a house, it’s important to understand the specialist words and phrases involved. Especially when a relatively obscure law from the 16th Century could mean you’re liable for huge bills due to the location of your property. So, what is chancel repair liability, and how could it affect you? More than […]

Continue reading >

Selling your house with problem neighbours

29 July, 2021

Structural repairs or home improvements are often a good idea if you’re preparing your home for a quick sale. But some issues can be a lot more complicated, especially when they involve third parties. So how do you go about selling your house with problem neighbours? Disputes and issues with the people next door are […]

Continue reading >

The best questions to ask when you’re viewing a house

There are a lot of things to remember during the home buying process, especially when the property market is moving quickly. It’s very easy to get distracted by imagining yourself in a new place and forgetting to enquire about all the details. So, here’s a helpful list of the best questions to ask when you’re […]

Continue reading >

How to stop the repossession of your home

The fear of losing your house is understandable if you’re experiencing financial difficulties. But it’s important to realise there are steps you can take at any stage to get things back under control, including how to stop the repossession of your home. When you’re struggling with mounting debts and being chased for payments, it can […]

Continue reading >

When was my house built?

21 June, 2021

If you’re buying or selling a property, taking out building insurance or just curious, most people will ask “When was my house built”. Knowing the age of your home can also reveal interesting historical information, useful construction details, and whether it’s likely to increase or depreciate in value. Typically houses under 50 years old would […]

Continue reading >

How to sell your house fast

16 April, 2021

If you want to seize a great deal on a new property, or if your circumstances change suddenly, you may be wondering ‘How do I sell my house fast?’. Before you rush to the estate agents in a panic, our guide will help you to value and sell your home quickly. And to still get […]

Continue reading >

Reasons Selling to a Cash House Buyer May Be Right for You

4 March, 2021

Selling to cash house buyers may not be for everyone, but for certain groups, it can be a life-saver – especially when you are in a difficult financial situation such as debt. While many people who use the traditional approach of using high-street agents may turn their nose up at the prospect, for others, it […]

Continue reading >

How To Avoid “We Buy Houses For Cash” Scams

Selling a house, for many, is not an experience that they would like to go through again any time in hurry. From choosing an agent, to the horrendous waiting for potential buyers to show interest – selling a house is often a nightmare from start to finish. Of course, anyone who works in the industry […]

Continue reading >

What Is a Property Cash Buyer?

5 February, 2021

For younger generations at least, the mere thought of owning a home at some point in their lives feels like an unattainable dream thanks to the constantly widening gulf behind house prices and wages – especially when it comes to raising enough money for a deposit. It’s somewhat shocking, then, for young people to learn […]

Continue reading >

All You Need To Know, For A Fast House Sale

So, you’ve decided you would like to or need to move house. While this should be an exciting time for anyone, it usually leads to a not insignificant amount of stress and sleepless nights. For some sellers, they can strike it lucky and receive an offer within a week of placing the home on the […]

Continue reading >

Things to Watch When Selling a House for Cash

6 January, 2021

Whether you are selling to a house-buying company or a private buyer for cash, it can be easy to get carried away with the thought of making a decent profit in a short space of time. However, it’s important to stay grounded when the opportunity presents itself and keep an eye out for red flags that […]

Continue reading >

Tips For Selling Your House Fast And At The Best Possible Price

Selling a house is an experience that many homeowners consider a necessary evil if they wish to upsize or downsize. Whether the stress comes from trying to find a decent agent, staying optimistic about viewings, or simply waiting for a buyer to make an offer – the house selling process is not one for the […]

Continue reading >

Should I Use A Quick-Property-Sale Company To Sell My House?

3 December, 2020

Selling a house in today’s world is not the easiest task. If you were to look back to merely the mid-nineties, the cost of reasonable housing was easily within reach of the less wealthy when studied alongside wage levels. Since those days, however, property prices have increased dramatically – placing them far out of reach […]

Continue reading >

Tricks to Sell Your Home Faster During The COVID-19 Pandemic

If, at the beginning of 2020 you were thinking about selling your home you’d be forgiven for approaching the situation in the traditional, standard fashion. However, 2020 has been anything except a standard year. Between the rapidly approaching Brexit deadline, continued austerity measures and the emergence of COVID-19, 2020 will likely go down in history […]

Continue reading >

Should You Use A Property Buying Company To Speed Up Your House Sale?

2 September, 2020

For many first-time homeowners, the stress of securing a house is enough to make you never want to experience the mortgage and purchasing process ever again – especially in an age where the ability to buy a first home is harder than it has ever been. It isn’t just first-time buyers, however, who can empathise […]

Continue reading >

How to Sell my Home Quickly & for the Highest Possible Price?

Those who wish to sell their homes, wish to make a profit. While many will try to pretend that they are flexible, in truth it is very hard for somebody who has worked for many years in order to buy a property to let it go without making every effort to achieve the highest sale […]

Continue reading >

How to Make Your Home More Valuable and Sell Faster

6 August, 2020

It’s fair to say that for the majority of people, beauty is in the eye of the beholder. However, with so many similar styles of houses across the country, it can be hard to make yours stand out from the crowd. So how do you make your home more valuable, and ultimately sell faster? Be […]

Continue reading >

Avoid These Mistakes When Selling Your Home

Putting a house on the market is hardly the easiest task in the world but luckily you can make life a little less stressful for yourself if you are able to avoid these mistakes when selling your home. Avoid Overpricing It’s extremely easy for a potential buyer to see whether or not you have inflated […]

Continue reading >

Options To Avoid Repossession Of Your Home

3 June, 2020

Whilst owning a home is a fantastic achievement, if you are unable to continue paying the monthly mortgage fees you could end up facing the prospect of your lender repossessing your home. In this article, we will look at the best ways to avoid repossession of your home should you find yourself in such a […]

Continue reading >

How to sell a house during the COVID-19 Lockdown

18 May, 2020

After over a decade of uncertainty stemming from the financial crisis in 2007, the property market was slowly beginning to show signs of recovery at the start of 2020. During February, not only were mortgage approval levels at record highs, but there had been over 70,000 sale completions1 – with many more buyers applying for […]

Continue reading >

How Has COVID-19 Affected The Property Market?

After slowly bouncing back from the trauma that was the financial crisis, many industry professionals were looking forward to a new decade filled with optimism and a housing market that would, over time become resilient again. Unfortunately, few would have guessed how the start of 2020 would have panned out with the outbreak of the […]

Continue reading >

How to sell your house without an estate agent

11 February, 2020

As anyone who has ever sold a home can testify, the house-selling process for can become ridiculously stressful thanks to the endless viewing schedule, the need to keep your home in showroom condition, and the need to constantly chase your estate agent for updates. But why do we become so dependent on estate agents? In […]

Continue reading >

How does selling a house with a mortgage work?

15 December, 2019

How does selling a house with a mortgage work? For those who are lucky enough to be on the property ladder, as time passes, they may find themselves needing more space than is offered by their current home. So how does selling a house with a mortgage work? Can you sell a house when you […]

Continue reading >

How to sell your house when separating or divorced?

30 November, 2019

How to sell your house when separating or divorced? Being in a committed long-term relationship offers a range of benefits, especially when you can combine your incomes to buy a home together. Sadly, however, these relationships don’t always last. So how do you go about selling your home when you are separating or divorcing? Do […]

Continue reading >

What are the costs of selling a home?

10 November, 2019

What are the costs of selling a home? For those who have little experience in selling a house, learning about the additional costs that are often associated with the process can turn the situation into a cost-prohibitive nightmare. But what are the costs of selling a home? What costs are involved with selling a […]

Continue reading >

How To Sell A House In A Slow Market

31 October, 2019

How To Sell A House In A Slow Market Selling a house often involves bowing to the power of the influences that affect the property market. There are, however, certain things that you can do to learn how to sell a house in a slow market. How does a slow market affect house sales? The […]

Continue reading >

When is the best time to sell a house?

18 October, 2019

When is the best time to sell a house? Selling a home has long been known to be one of the most stressful experiences you can go through. However, with a little bit of research, it is possible to increase the saleability of your home and make life a little easier. What time of year […]

Continue reading >

How to sell your house in winter?

28 September, 2019

While many property professionals prefer to advise their customers not to aim for a winter house sale, many vendors find that it is unavoidable for a variety of reasons. Luckily, the chances of selling a house in winter aren’t low as many people believe. When is the best time of year to sell a house? […]

Continue reading >

What Does a Recession Mean for House Prices?

15 September, 2019

With rumours growing over recent months surrounding the possibility of another severe recession taking place sometime in the near future, many homeowners are asking how this could affect the value of their home. What is a recession? If you have lived through the eighties, nineties and noughties – it’s more than likely that you will […]

Continue reading >

How To Sell Your Home At Auction

5 September, 2019

There have never been more options open to the prospective property seller than there are now. From fast cash buyers to part-exchange and traditional estate agent sales, the choice is yours – so why do some favour the age-old process of property auctions, and what exactly does it involve? Why Sell At Auction? Offering a […]

Continue reading >

How Brexit Has Made Homeowners Turn to Quick House Sales

10 July, 2019

After three years of political back-and-forth, misinformation and numerous allegations of corruption, the UK is due to leave the EU on October 31. However, amid all the confusion and turmoil, it appears that homeowners are likely to be bearing the brunt of the economic damage for years to come. What exactly is Brexit? Brexit. A […]

Continue reading >

Prominent estate agent gives profit warning

3 May, 2019

Shareholders have found themselves reeling from an announcement that Countrywide – the country’s largest estate agent – is due to miss its projected targets for Q1 2019 by up to £5m. With large numbers of estate agents closing their doors every month due to a slowing economy, Brexit anxiety and a lacklustre property market, it […]

Continue reading >

Market flooded as landlords decide to sell

30 April, 2019

As buy-to-let mortgages become less and less affordable, large numbers of landlords are choosing to leave the sector and sell their properties – and this influx of sellable low-price homes are driving down prices for vendors across the country. For many years, being a landlord has been a profitable occupation, with rental payments easily exceeding […]

Continue reading >

More House Sales Affected By Crime

17 April, 2019

New research claims that more than 29,000 house sales fall-through every year due to fears over local criminal activity. For as long as properties have been bought and sold, buyers who have the option will always state their preference to live in a low-crime area. This is obviously unsurprising considering many purchases are made by […]

Continue reading >

How Will Brexit Affect House Prices In The UK?

14 April, 2019

As the UK passes the original deadline for Brexit, many industries continue to be affected by the ongoing confusion regarding the state of the markets if the country leaves the European Union. But how will Brexit affect house prices in the UK? How does Brexit affect the property market? The property market is heavily tied-in […]

Continue reading >

UK Property Construction At Lowest Point For 12 months

21 March, 2019

With only ten days to go before the UK leaves the EU without a deal, levels of house-building throughout the country have fallen to their lowest levels in over a year as construction companies opt to delay the start of projects. When David Cameron attempted to silence the Eurosceptics within Parliament in 2016 with a […]

Continue reading >

Are buy-to-let properties a good investment?

14 March, 2019

For many years, landlords have reaped the rewards of property investment – but are the same opportunities for profit available to those looking to start a buy-to-let investment today? How do buy to let properties work? The buy-to-let system allows an investor to purchase a property with the sole intent of profiting from a tenant […]

Continue reading >

Sellers Despair As Market Favours Buyers

8 March, 2019

The property market has grown in favour of buyers in recent months as house price growth continues to be stifled by a lack of confidence over the UK’s economy in light of Brexit. As the UK gets closer to springtime, vendors who are looking to sell their house fast are often preparing their home for […]

Continue reading >

Fears Grow As Sales Expected To Plummet

27 February, 2019

The Royal Institution of Chartered Surveyors have recently released the results of a survey conducted amongst its members in regard to the future of the property industry, and the results are not encouraging. When valuing homes, surveyors have to take many factors into consideration when they provide what they consider to be accurate sold house […]

Continue reading >

Estate Agencies Taking Advantage of Desperate Sellers

19 February, 2019

Due to falling profits, greedy estate agents have been charging desperate fees as high as £7,000 to sell their homes. Sometimes, a homeowner needs to sell their home fast, and if the need to secure a sale overrides the need to profit from the home in question, they can inadvertently open themselves up to a […]

Continue reading >

Who Pays Stamp Duty When You Sell A Property?

13 February, 2019

Stamp duty is a tax on the sale of a property in order to cover the cost of processing the necessary documents during a sale. But who pays stamp duty when you sell a property? When Do You Pay Stamp Duty? There are a standard set of rules within the UK determining when, where and […]

Continue reading >

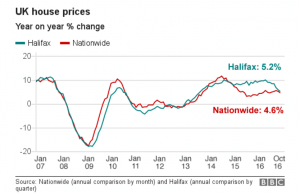

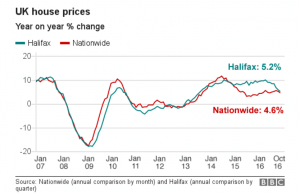

House Prices Hit New Low

6 February, 2019

With the Brexit deadline looming, the property market is continuing its downward trend as buyers continue to gain the upper-hand over sellers. Industry experts are warning those that are hoping to sell their house fast to prepare themselves for lower-than-expected offers after the latest House Price Index was published by Nationwide this month. The press […]

Continue reading >

House-building projects at risk due to new immigration policies

29 January, 2019

As the Brexit deadline looms, the UK housebuilding industry is facing an uphill battle as a result of proposals for new policies that could limit the influx of low-skilled EU workers. For those who work within the construction industry, it is common knowledge that the workforce is made up from workers originating from a number […]

Continue reading >

How Universal Credit is fuelling the UK housing crisis

24 January, 2019

As Universal Credit continues to bring misery into the lives of many people who are unable to work, industry experts are realising that its implementation is forcing cash-strapped councils to abandon plans for new-build homes. When Iain Duncan Smith introduced the idea of Universal Credit almost ten years ago, the idea was to simplify and […]

Continue reading >

Market Stalls As First-Time Buyer Sales Fall

19 January, 2019

Just before the new year, Haart – the UK’s largest independent lettings and estate agent – released data related to the final quarter of 2018 – and the news isn’t great for the property industry. When the government cut stamp duty for first-time buyers in 2017, the government assumed that this would spur an influx […]

Continue reading >

How to value your house

9 January, 2019

There are many factors that can affect the value of your home – some of which could surprise you. So how do you accurately value your home? How much is your house worth? While many homeowners feel as if they can gauge the true value of their home, more often than not, there will always […]

Continue reading >

Shock as rental costs increase by 345% in 18 years

3 January, 2019

For many Brits today, the dream of owning a home continues to slip away as their income is eaten up by every-rising rental rates while the houses they dream of buying become increasingly unaffordable as values continue to rise. In days gone by, renting instead of purchasing a home had a number of benefits, including […]

Continue reading >

Sellers in shock as asking prices fall to new lows

28 December, 2018

As fears regarding Brexit continue to affect the housing market, sellers are finding themselves having to continually reduce their asking prices in order to entice buyers – leading to the weakest market growth since 2010. Whether you need to sell your house fast, or are happy to wait until the right offer comes along, all […]

Continue reading >

Brexit warning: expect lower sales and housing values into 2019

19 December, 2018

With only 100 days until the deadline for Brexit expires, a new report by the Royal Institution of Chartered Surveyors (RICS) warns sellers and agents alike to prepare for a difficult market throughout 2019. In a survey carried out in November this year, surveyors from across the UK are extremely pessimistic regarding the future of […]

Continue reading >

How to avoid repossession of your home

16 December, 2018

While many consider it a personal dream to own a home, the dream can quickly turn into a nightmare if you are unable to keep up with the repayments. In this article, we’re going to look at the repossession process, and how to avoid it. How does a house repossession work? The term ‘house repossession’ […]

Continue reading >

Housing market crash as Brexit hits home

5 December, 2018

After a tumultuous few weeks of negotiations, the reality of Brexit and how it will affect the UK economy if we leave the EU without a deal has led to the worst sales slump in the housing market since 2012. When the Brexit referendum was announced, many saw it as an attempt by then PM […]

Continue reading >

The rental trap: 72% say that lottery win is the only way out

28 November, 2018

A think tank has carried out a survey across England and Wales to mark the launch of the Affordable Housing Commission, the results of which have painted a depressing picture of the UK’s housing crisis. Chaired by Lord best, the Affordable Housing Commission has been established to find solutions to the problems endured by members […]

Continue reading >

Northern House Prices Predicted To Soar

20 November, 2018

After years of price rises fuelling the southern property market, the introduction of new lending rules combined with more attractive northern propositions are due to turn the North-South divide upside down, according to Savills. In a shocking new forecast released by real estate advisor Savills, homes in the north are expected to see their values […]

Continue reading >

The secrets behind how to sell a property successfully

14 November, 2018

Selling a house is never a stress-free experience but being prepared can help you to complete a sale as efficiently as possible. While many homeowners love the idea of moving to a nice new property, the move itself is often hindered by the sale of their current home. So how do you ensure that the […]

Continue reading >

Shock As Mortgage Approvals Down By Ten Per Cent

8 November, 2018

New figures published by UK Finance have painted a worrying picture for the future of the housing market, as mortgage approvals continue to fall. In September this year, the number of mortgages successfully applied for fell by 10.1% versus 12 months ago. As fears over a no-deal Brexit loom, approvals have now fallen for three […]

Continue reading >

Crisis As New Mortgage Deposits Unaffordable For First Time Buyers

1 November, 2018

As rental fees continue to rise, the additional costs to tenants is forcing those who may once have been prospective buyers to put their lives on hold as they struggle to find the money for a mortgage deposit. The issues facing those living in rented accommodation across the UK have been well documented in recent […]

Continue reading >

The Top Ten Worst Places To Sell a Home In The UK

24 October, 2018

No matter the quality or condition of a home, if it is located in an area that offers little in terms of services or personal safety then the vendor will always find themselves consistently lowering their asking price in desperation to complete a sale. If you’re browsing through listings on an online portal such as […]

Continue reading >

We are about to face the worst recession in almost 100 years

17 October, 2018

As consumer spending continues to slow, financial analysts predict that the upcoming global recession could lead to a downturn in the UK economy on par with the Great Depression. Since the mid-1950s, recessions have brought the UK economy to its knees with staggering regularity. Regardless of their cause, these recessions have forced thousands of ordinary […]

Continue reading >

The Secret To The Best Time To Sell Your Home

11 October, 2018

Finding the best time to sell a property is not always easy in the UK thanks to our inconsistent weather and the complexities associated with the house-selling process. Luckily, in this blog we’re going to discuss the best time to sell your house, and how to use this information to ensure a high value sale. […]

Continue reading >

Leasehold property owners just can’t sell…

3 October, 2018

As the dark truth behind leasehold properties continues to be exposed through lawsuits and government initiatives, homeowners lacking freehold status are finding out that their property is impossible to sell. The house buying process is extremely stressful for the majority of people – and in the midst of all the stress, it can be easy […]

Continue reading >

The insider secrets that can lower the value of your home

26 September, 2018

In this blog, we’re going to look at the more unusual factors that influence the saleability of your house, and what you can do to ensure you get the best price possible. If you’re looking to sell your house fast, it can be surprising how even the smallest things affect the value of your home, […]

Continue reading >

Panic as house prices crash at fastest rate for years

19 September, 2018

As the UK edges towards the deadline for striking a deal with Brussels regarding it’s exit from the EU, Nationwide has issued a stark warning for the future of the nation’s housing market. At the beginning of the month, the Office for National Statistics determined that house prices were falling at their fastest rate since […]

Continue reading >

How to sell a property online

13 September, 2018

Not happy with your local agent? In this blog, we’re going to look at the best ways to sell your home online. Where to sell a property online As technology progresses, the traditional method of buying and selling property via a high street estate agent is slowly disappearing. In the last five years alone, almost […]

Continue reading >

‘No fault’ evictions are to blame for rising levels of homelessness

6 September, 2018

As landlords take advantage of ‘no fault’ clauses in rental agreements, tenants are finding themselves priced out of their homes when their rental term comes to an end. It’s no secret that rising rental rates have been a big factor in preventing tenants from saving up for a deposit to buy their own house. Over […]

Continue reading >

Older individuals are now choosing to rent in their retirement

29 August, 2018

A rising number of retired Brits are finding that due to the increasing price of property across the UK, it makes more sense for them to rent luxury retirement apartments instead of buying them. When the media discusses the idea of ‘Generation Rent’, it often conjures up images of millennials and members of ‘Generation Z’ […]

Continue reading >

Is this the end for high street estate agents?

23 August, 2018

Estate agents appear to be the latest victim of the modern high street as consumers move to online competitors. The face of the UK high street has undergone a dramatic change over the last 15 years as a result of increased internet-based competition and lofty overheads. In many town centres, it’s hard to ignore the […]

Continue reading >

Fresh nightmare for sellers as the ONS releases its latest affordability figures

16 August, 2018

The latest statistics regarding the affordability of a home for a first-time buyer in the UK highlight the growing gap between house prices and wages. To highlight the difference between average sold house prices and average wages, the Office of National Statistics has, for many years now, used the “affordability ratio” to illustrate the state […]

Continue reading >

Can a landlord sell a house during a lease? and What are my rights if this happens?

9 August, 2018

The sale of a rented home can easily become a confusing affair, so it’s always important to understand the legal rights of both the tenant and landlord. So, you’ve just found out that your landlord wants to sell the house you’re renting. While there’s no reason to panic, it’s always useful to know the status […]

Continue reading >

New report details the worrying state of the UK housing market

31 July, 2018

A new report has provided more evidence that the housing market is stagnant and experts within the industry believe that there is little chance of recovery in the near future. Newly released data from HMRC has shown that house sale completions were down by 5.7% in June versus the previous year. Even more worrying is […]

Continue reading >

Owning is now cheaper than renting everywhere in the UK

25 July, 2018

New market research by Santander Mortgages has found that there is now no part of the country where it is cheaper to rent than own. It is a sad state of affairs when society presents a glass ceiling to those who find themselves stuck in the rent cycle. For many Brits, purchasing a home of […]

Continue reading >

Estate agent group Countrywide on the brink of collapse

19 July, 2018

As industry woes continue for large numbers of estate agents, the UK’s largest agency group Countrywide have seen their shares fall to an all-time low. Just over a decade ago prior to the economic downturn, estate agents across the country found themselves in a constant state of elation as sub-prime mortgages saw large numbers of […]

Continue reading >

Single first-time buyers need a decade of savings to fund a deposit

3 July, 2018

A new report has found that single first-time buyers need to save for over ten years to finance a deposit for a mortgage, making it harder for sellers in starter homes to find a buyer. In recent years, it has become clear to both vendors and estate agents that finding a buyer for a starter […]

Continue reading >Third of homeowners would not be able to afford their own home today

26 June, 2018

A new survey has found that a third of British homeowners would be unable to afford their home if they had to re-purchase it today thanks to record value increases. We often hear about the ever-widening gulf between wages and sold house prices, yet the quantitative data provided rarely illustrates the points in a fashion […]

Continue reading >UK lending continues to increase thanks to ‘bank of mum and dad’

19 June, 2018

Lending has continued to increase year on year, but closer scrutiny reveals that this rise may not be the result of a stronger market. New data released by the trade association UK Finance has shown that there was an 13% increase in lending during April compared to the year before. Whilst this may appear to […]

Continue reading >When is the best time to sell your house in the UK?

13 June, 2018

Selling a house in today’s market can be a nightmare – but knowing the best time to sell can save you a lot of hassle. If you need to move house for the sake of work, or simply to be closer to family, you’re probably crossing your fingers and hoping to sell your home fast. […]

Continue reading >UK housing market continues to weaken

7 June, 2018

A new blog report by the Office of National Statistics has delivered further bad news regarding the state of the UK property market as a result of various legislative changes and Brexit insecurity. The property market has continued its woeful performance this month with news that house price growth in the capital has hit its […]

Continue reading >

Councils under fire for banking unspent public funds

30 May, 2018

A number of councils across the UK have found themselves at the centre of a fresh scandal thanks to the discovery of large amounts of public cash meant for spending on infrastructure residing untouched in their bank accounts. When the Town & Country Planning Act came into force in 1990, there was a minor piece […]

Continue reading >

Millennials facing a lifetime of rent

24 May, 2018

As the gap between house prices and wage increases continues to grow, new research predicts that a growing number of millennials will be renting for the rest of their lives. If you were to ask the average person on the street what they hope to achieve in life before they turn 40, more often than […]

Continue reading >

Government vows to keep rogue estate agents in check

16 May, 2018

In an effort to keep rogue estate agents in check, the government is proposing legislation for all businesses to require a professional qualification, while simultaneously introducing guidelines that could help the house-buying process become more transparent. As of 2018, there are currently over 20,000 estate agents operating in the UK. This is somewhat unsurprising considering […]

Continue reading >

How to sell a house online

10 May, 2018

In times gone by, the methods by which an individual could sell their home were extremely limited. However, thanks to the rise of the internet and e-commerce, vendors have a multitude of options available to them. Thanks to numerous headlines regarding the underhanded business practices of a small number of individuals, the reputation of high […]

Continue reading >

RICS warns of reduced demand for housing in 2018

2 May, 2018

With lower levels of borrowing, combined with reduced activity within the property market, sellers are being warned that the days of high asking prices may be numbered. As the UK heads towards what is usually considered a period of heightened activity within the property market, vendors who are looking for a fast house sale are […]

Continue reading >

Vendors cutting asking prices to encourage sales

25 April, 2018

With agencies across the country encouraging sellers to make repeated cuts to their asking prices in the hopes of achieving a sale, a growing number of vendors are choosing less traditional routes to find a buyer. Selling a house is long and complicated process for any owner – but there is always an underlying feeling […]

Continue reading >

Foreign buyers having a marked effect on UK home ownership levels

18 April, 2018

As a result of increased foreign investment in the UK property market over the last 20 years, house values have risen considerably and prevented younger Brits from being able to buy a house themselves. Buying a home in the UK is not an easy task for those in the younger generations, with house prices increasing […]

Continue reading >

How to sell a house fast

11 April, 2018

Selling a house is an experience that many homeowners consider a necessary evil if they wish to upsize or downsize. Whether the stress comes from trying to find a decent agent, staying optimistic about viewings, or simply waiting for a buyer to make an offer – the house selling process is not one for the […]

Continue reading >

London house prices continue to plummet

4 April, 2018

In the wake of the Brexit referendum, the apprehension felt by the majority of Londoners regarding the decision to leave the European Union appears to be well founded based on new data released by Hometrack. While many other of areas of the UK have, so far, managed to escape the negative outcomes that so many […]

Continue reading >

High street agents losing out to online rivals

27 March, 2018

As the business world continues to move away from traditional shopfronts, high street agents are slowly realising that the future may not be as promising as once hoped. For decades, high street estate agents have enjoyed a bountiful supply of potential home buyers coming through their doors on a daily basis, but their dominance over […]

Continue reading >

House values continue to plummet amid Brexit fears

22 March, 2018

New market research from Halifax has shown that the continuing uncertainty surrounding the UK’s relationship with the EU is having a worrying effect on London house prices. If you’re one of the many homeowners within the UK looking to sell your house fast, you may be asking yourself “how much are properties in my area?” […]

Continue reading >

How much are estate agent fees?

14 March, 2018

If you’re looking to sell your house fast, there’s a good chance that you’ll be on the lookout for an online or high-street estate agent. However, with so many agents around the UK, it can often be hard to find one that you can trust to sell your house successfully with an offer as close […]

Continue reading >

House price growth ‘locking out’ middle earners

8 March, 2018

With home-ownership becoming an increasingly exclusive club, a new study has found that even those lucky enough to be considered middle-earners are being locked out of the housing market. The last 20 years have seen a consistent growth in house prices, while average wages have only increased at a seventh of the rate in the […]

Continue reading >

Thousands to lose mortgage support benefit from April 2018

28 February, 2018

As a result of continued efforts by the government to reduce the national debt, many are finding that it is those living in low-income households who are bearing the brunt of the austerity measures. Since 1948, those who own a house but struggle to keep up with their mortgage payments have always had a lifeline […]

Continue reading >

Mortgage sales continue to drop throughout UK

21 February, 2018

A new report from Equifax Touchstone has left many industry leaders on edge after finding that mortgage sales dropped by 38% from November to December. After a tumultuous year for the property industry, the final month delivered news that many within the industry would have preferred to avoid. While December is expected to usher in […]

Continue reading >

Can you sell a house with asbestos in the UK?

14 February, 2018

Across the country, there are a number of older properties that still contain the toxic material, and its presence can often deter potential buyers for good reason. So how do you sell a house that contains asbestos? Asbestos is a silicate mineral has been mined for over four thousand years around the world. With a […]

Continue reading >

Estate agents pressuring buyers to use overpriced in-house services

7 February, 2018

A new report has shown that one in four buyers felt obliged to use an estate agent’s in-house services over personally-sourced independent alternatives. Individuals who browse the market with the intention of buying often forget about the additional costs associated with a purchase. From conveyancing and mortgage brokerage, to various utility and property searches, it […]

Continue reading >

Vendors cutting prices to encourage sales

30 January, 2018

As insecurity regarding the outcome of the UK’s planned exit from EU continues, vendors are slashing their prices to increase the likelihood of a sale. Vendors across the country are slashing their asking prices in an effort to sell their homes fast, as fears grow that once Article 50 has been finalised, the value of […]

Continue reading >

Selling a hoarder’s home

24 January, 2018

While many people enjoy tuning into reality television shows that expose the nightmarish conditions within which many hoarders live, the reality behind the ratings push is often much more morbid. Many of us know, or have known an individual who lives in a hoarder house, and are more than aware that the problem has its […]

Continue reading >

First time buyer deposits to rise to £81k within a decade

17 January, 2018

Analysts believe that owning a home is becoming an increasingly exclusive club as the amount needed for a deposit continues to rise, despite government promises to the contrary. For younger generations, the dream of owning a house of their own has faded greatly over the last 20 years. Since the turn of the millennium, house […]

Continue reading >

How to sell a house that needs work done

10 January, 2018

For those who need to sell their house fast but don’t have the time to renovate, finding a buyer willing to pay a decent sum is hard work – so how do you maximise your profit? Many individuals purchase a home with the hopes that, over time, they can renovate it. However, by the time […]

Continue reading >

Estate agents warned over false advertising

4 January, 2018

Estate agents across the country are finding themselves at the mercy of both the ACA and CAP for not disclosing additional fees to clients as well as inaccurately describing their listed properties. Estate agents have long suffered from the stigma of dishonesty. Whether or not this stigma is deserved en masse remains to be proven, […]

Continue reading >

Mortgage applications affected by Universal Credit scheme

27 December, 2017

The beleaguered Tory-led benefits scheme known as Universal Credit is again under fire as reports surface that claimants are unable to use their income from benefits as proof of earnings during the house-buying process. When Tory MP Iain Duncan Smith pushed for a revamp of the country’s benefits system in 2011, many of those already […]

Continue reading >

Fears rise over the future of the market as mortgage approvals fall

20 December, 2017

According to the trading body UK Finance, mortgage approvals across the UK have hit their lowest level in 13 months – sparking fears that the housing market could be headed for a sharp decline. In his Autumn Budget, the chancellor stated that the Tory-led government would be taking steps to encourage new buyers to join […]

Continue reading >

Why can’t I sell my house?

13 December, 2017

If you find yourself in the unenviable position of being unable to sell your home, fear not – as there are always steps you can take to maximise your chances of a successful sale. Selling a house is often described by those who have been through the process as a complete and utter nightmare. However, […]

Continue reading >

Autumn Budget 2017: how will it affect the property industry?

6 December, 2017

With the continuing housing crisis casting a shadow over Hammond’s Budget – the chancellor hopes to alleviate the fears held by many prospective home buyers. Philip Hammond, the current Chancellor of the Exchequer laid out his plans on November 22nd to aid the struggling property industry via a series of radical changes to the rules […]

Continue reading >

Rental rates continue to rise as cheap housing remains unaffordable

29 November, 2017

As rising house prices continue to prevent younger, less wealthy buyers from purchasing, landlords have been capitalising on the situation by acquiring cheaper homes and enjoying consistently rising rental rates. One of the greatest difficulties experienced by prospective buyers in rented accommodation is the ability to raise the necessary deposit for a mortgage. Unfortunately, thanks […]

Continue reading >

Retired sellers hoping to downsize unable to find younger buyers

22 November, 2017

As the cost of living for younger generations continues to grow, older homeowners who need to downsize are finding themselves unable to find a buyer with the necessary financial resources. For many millennials, hearing the constant tirade from older generations about how they complain too much and “don’t know the meaning of a hard day’s […]

Continue reading >

UK housing market appears to stall amid increase in interest rates

15 November, 2017

With the decision made to increase interest rates, buyers and sellers appear unlikely to enjoy the continuing financial respite necessary for the housing market to recover. Despite the fact that the economic crisis occurred over ten years ago, as a nation, we are still feeling the aftershocks. With the economy beginning to stall in 2007, […]

Continue reading >

How to sell your house without an estate agent

8 November, 2017

Selling a house can be a stressful experience. Even so, more and more sellers are choosing to decline the use of an agent in favour of more profitable options. For the majority of people looking to sell their house fast, the use of an estate agent seems like a great idea. While agents do take […]

Continue reading >

House Prices Set to Fall as Consumer Confidence Nosedives

1 November, 2017

With growing public concern that house prices could fall in the near future, vendors who need to sell are finding themselves between a rock and a hard place. The latest figures released by Halifax from their house price optimism index have painted a worrying picture for those who are looking to sell their house fast. […]

Continue reading >

Lengthier mortgage terms on the rise for potential buyers

25 October, 2017

As properties become less affordable for prospective buyers, the number of applications for 35-year mortgages are increasing dramatically. For many first-time buyers in today’s housing market, the ability to secure a mortgage by raising the necessary funds for a deposit is considered a major triumph. However, with ever-increasing prices, the crowning achievement of becoming a […]

Continue reading >

Vendors opting to remortgage rather than sell

18 October, 2017

With interest rates increasing, vendors are choosing to remortgage their homes as opposed to selling – causing a slump in the number of homes being bought and sold. In the wake of the financial crisis of 2007, homeowners have enjoyed low monthly repayments thanks to reduced interest rates. However, with fears growing that the market […]

Continue reading >

How to sell your house quickly

11 October, 2017

So, you’ve decided to sell. But what steps can you take to ensure that you find a buyer within a reasonable time-frame? Moving home is hardly the most stress-free experience for the majority of us. Once the initial excitement of deciding to sell and move on has died down, we’re left with the task of […]

Continue reading >

Falling asking prices spark panic among vendors

4 October, 2017

The postcode lottery continues for many homeowners thinking about selling in the near future as asking prices across the country take a further hit. New figures released by online property giant Rightmove have painted a worrying picture for those who need to sell their house fast as the expected autumn spike in prices has failed […]

Continue reading >

Bank of mum and dad now covering rent payments

27 September, 2017

As the affordability of buying a house continues to decrease, new research has shown that younger people are now finding it just as hard to afford rental payments without parental aid. For years now, parents have been helping their offspring to gain a foothold on the property ladder by helping to pay for the necessary […]

Continue reading >

Increasing average house prices spell trouble for less desirable areas

20 September, 2017

As younger generations urge the government to find a way to lower house prices, research by the online estate agent eMoov has shown that the affordability gap between wages and property is continuing to widen. The postcode lottery that is the property market has maintained its grip on whether or not potential buyers can afford […]

Continue reading >

Who pays the commission when you sell a house?

12 September, 2017

When property changes hands, it’s not always straightforward how the associated fees are calculated – and to whom they are paid. The situation is made even worse when you realise that different methods of selling a home demand different types of fees, so it can often feel like a figurative minefield. No matter which process […]

Continue reading >

ACA finds more online estate agencies’ claims to be dishonest

6 September, 2017

In a further blow to the reputation of the online estate agency industry, the advertising watchdog has cast its critical eye towards market leaders Purplebricks and Housesimple, for making misleading claims regarding their services. As more house sellers find themselves moving towards online as opposed to high street estate agencies in a bid to save […]

Continue reading >

First homes becoming a distant dream for younger generations

30 August, 2017

The recent English Housing Survey carried out by the UK government has painted a truly depressing picture for prospective house buyers across the country, as the true scale of rising property prices is revealed. As younger generations slowly begin to increase their proportion of the UK population, we have begun to see more and more […]

Continue reading >

Mortgage approvals fall to nine-month low

23 August, 2017

Mortgage approval figures have fallen for the ninth month in a row, as inflation, rising house prices and wage stagnation continue to blight the housing industry. Many within the housing industry are at odds with one another with regards to the new figures released by the UK trade body UK Finance. The report has detailed […]

Continue reading >

Estate agent’s profits slashed as economy woes continue

16 August, 2017

A new study by accounting firm Moore Stephens has found that one in five estate agencies in the UK are feeling the strain of a weakening economy, as industry leaders Countrywide and Foxtons also see profits slump. Almost 14 months on from the Brexit referendum, and it appears that many of the fears voiced by […]

Continue reading >

When is the best time to sell a home?

9 August, 2017

As many property professionals can testify, the housing market can be volatile – but that doesn’t mean there aren’t steps you could take to maximise your chances of a quick house sale. The period between the day you place your home on the market and the day you finally sell can be a nightmare. Sellers […]

Continue reading >

Leaseholds to be banned on new-build homes

2 August, 2017

With outdated laws still being used to unfairly profit from homeowners who pay ground rent, the government is taking action to prevent new developments from being classified as leasehold. In the days of feudal law, land ownership dictated power. Those who wished to make a living from the land but lacked the necessary resources to […]

Continue reading >

Number of hopeful first-time buyers living with parents is on the rise

26 July, 2017

With no other option, potential buyers from younger generations have found themselves having to move back into their parents’ homes to generate the necessary income for a deposit. There’s no doubt in the current economic climate that it’s tough for those looking to buy their first home. With high prices and low wages, it can […]

Continue reading >

Number of house sales continues to fall

19 July, 2017

While the country continues its trajectory through turbulent times – with the Brexit negotiations, the surge of the Labour party and a lack of new-build homes – the total number of houses sold is continuing to fall year-on-year. It’s been a decade since the last major financial crisis in living memory, and according to recent […]

Continue reading >

How to sell a house at an auction

12 July, 2017

When a seller is faced with several different options to sell their house, they often find the prospect of using an auctioneers quiet tempting. But how do auction houses work? And are they worth your time and trouble? How confident are you that your house is a purchaser’s dream? Do you like to gamble? Are […]

Continue reading >

Number of tenants on the rise – so does that mean fewer buyers?

5 July, 2017

New research by a prominent estate agent has found that the number of households having to rent rather than own is set to rise by over 20 per cent over the next five years. In days gone by, choosing to rent a property over buying a home was a preference for many for a variety […]

Continue reading >

First-time buyers’ hopes of purchasing a home are slipping away

28 June, 2017

Younger buyers are losing out on gaining a foothold on the property ladder due to a lack of protection from unsuccessful purchases and ever-rising costs associated with moving home – which, of course, is also bad news for sellers. For many young people, owning a house can seem little more than a pipe dream, given […]

Continue reading >

Changes to landlord tax affecting UK property owners

21 June, 2017

Due to financial relief changes by the Tory government that came into force in April, landlords are finding themselves having to pay up to three times more taxes than before. For many years, many government officials have blamed the wealth of landlords for buying up cheap homes and thereby preventing prospective first-time buyers from […]

Continue reading >

How long does it take to complete a house sale after an accepted offer?

13 June, 2017

Whether you’re buying or selling, the length of time it can take to finalise a sale can vary wildly no matter who you are. So, what are the key influences for speed in the house-buying process? Often, when you’re looking to buy or sell a house, it can feel as if you are out in […]

Continue reading >

GE2017: A hung parliament and the future of the UK economy

9 June, 2017

A shocking General Election result with the highest youth turnout in recent history appears to have thrown the Tory party into panic. But how will a hung parliament and the ensuing drama affect the rest of us – and especially our housing? The young British voting public could be forgiven for becoming numb to the […]

Continue reading >

GE2017: What’s the future of the housing crisis?

7 June, 2017

With a narrow Tory win on the cards and repeated U-turns over housing plans, some industry experts are concerned about how the UK will cope with a further five years of Conservative rule. When Theresa May called for a snap election in April, it was widely viewed as a strategic act of capitalising upon […]

Continue reading >

How long do you take before deciding upon a house?

31 May, 2017

While buying a house is considered to be one of the most important decisions a person can make, a new survey has shown that most of us take more time to choose a new television. The online property portal Zoopla has released the results of a survey illustrating the length of time average Brits take […]

Continue reading >

The increasing influence of the ‘Bank of Mum and Dad’

24 May, 2017

As house prices rise, and first-time buyers find it harder to gather the necessary resources for a deposit, a new report has said that parents are now the 10th largest UK mortgage lender in the country. The latest figures from insurer Legal and General have suggested that parents will lend a total of £6.5bn […]

Continue reading >

Housebuilding firms accused of purposefully inflating prices

17 May, 2017

With a monopoly over the housebuilding market, larger firms have been accused by MPs of ‘landbanking’ in an effort to keep prices high. With a quarter of all new-build homes in the UK in 2015 built by just three companies, MPs believe that the dominance of Persimmon, Taylor Wimpey and Barratt may be fuelling […]

Continue reading >

How to sell a house privately

10 May, 2017

Looking to move home without breaking the bank? With a plethora of options available to vendors to find potential buyers, you may be wondering how easy it is to sell a house without an agent. So how easy is it to sell a house on your own? The ease with which a seller can […]

Continue reading >

First-time buyers face further woes

3 May, 2017

As new-build housing continues to fall behind government targets, first-time buyers are facing additional issues as a result of foreign investment competition. The difficulties involved in the house buying process for first-time buyers have been well established due to the ever-widening gap between house prices and wages. In an effort to remedy the disparity, […]

Continue reading >

Are the self-employed facing an uphill battle to secure a mortgage?

26 April, 2017

Despite many countries rewarding those in self-employment, the UK appears to be stuck in the past with regard to aiding those financially who choose to be self-sufficient. Between 2008 and 2015, the number of people who chose to be self-employed had risen from 3.8 million, to 4.6 million. While the government triumphed the news as […]

Continue reading >

How will the UK General Election and French election affect the housing market?

19 April, 2017

Property professionals are currently holding their breath regarding the future of the UK economy, thanks to the dramatic calling of a snap election by PM Theresa May and the impending result of the French election, along with its implications for the EU. The two standout events of 2016 that shocked the world of politics are […]

Continue reading >

How long to sell a house?

12 April, 2017

The excitement we all feel when we decide to move to a new home is self-evident, but it’s also a situation that’s fraught with trepidation, due to apprehension over placing our own home on the market. So, exactly how long can it take to sell a house? Moving house is known to be one of […]

Continue reading >

Worries over Brexit and the shortfall in planned new-builds

5 April, 2017

While many pro-Brexit campaigners are heralding the move by Theresa May to trigger Article 50, the more apprehensive pro-remain supporters are worried about the effect of lower immigration levels on the UK housing industry. Experts believe the number of homes planned to be constructed across the country is woefully inadequate for the growing population, despite […]

Continue reading >

What is my house worth?

29 March, 2017

It’s not always easy to keep track of the fluctuations within the property market that affect the value of your home. But if you’re thinking of selling, you’ll most likely find yourself asking “exactly what is my house worth?”. Of course, the answer you receive is not always the one you want to hear. So […]

Continue reading >Movers and shakers: The geographical lottery of house values

22 March, 2017

With a difficult year behind us, new research by eMoov has uncovered the areas of the UK where house prices have been affected the worst. No matter who you are, it’s pretty clear that 2016 wasn’t the greatest year for the property industry. Despite exhibiting a relatively strong performance, the market – and by proxy, […]

Continue reading >

Estate agents found to be inflating asking prices to lure in vendors

15 March, 2017

A new study has found that vendors using estate agents are often having to reduce their asking prices as well as suffer an extended period on the market due to ‘greedy’ businessmen who quote unrealistic figures. Estate agents, in an effort to secure new clients, have been overvaluing properties before placing them on the market […]

Continue reading >Is fear of Brexit having a negative effect on house prices?

8 March, 2017

Areas of the UK where the population voted more strongly to leave the EU are enjoying faster house price growth than their ‘pro-remain’ counterparts – causing many homeowners to ask “how much is my house worth?” in the light of ongoing Brexit discussions. Recent research analysis by the HomeOwners Alliance has found that homeowners in […]

Continue reading >

Market confidence drops as homes take longer to sell

1 March, 2017

A new study has suggested that a slowdown in the housing market is on its way, as economic uncertainty and a lack of consumer confidence predict an 11 per cent decline in transactions. According to new research by The Times, experts within the property industry believe that market stagnation could lie ahead, as many vendors […]

Continue reading >

The regional division of negative equity in property

22 February, 2017

Almost ten years has passed since the recession – and it seems that homeowners in the north, particularly those who bought with interest-only mortgages, are facing a difficult future. In 2009, the financial crisis saw the value of homes come crashing down. Prior to the crisis, prices had skyrocketed – leading many to believe that […]

Continue reading >

Further price hikes expected for renters over the next five years

15 February, 2017

According to a new survey by the RICS, rental fees across the country are expected to rise faster than house prices by 2021. The new survey, commissioned by the Royal Institute of Chartered Surveyors, is yet another nail in the coffin for the dreams of those who hope to buy, but are unable to gather […]

Continue reading >

Estate agents seeking ‘pre-contract deposits’ from buyers

8 February, 2017

Various estate agencies have come under fire for demanding additional fees from buyers to demonstrate their commitment to purchasing a property. While in theory this may seem like a good way to ensure a buyer doesn’t back out of the purchase at the last second; in reality, there have been horrified reactions. It seems that […]

Continue reading >

Manipulation of freehold land affecting leasehold sales

1 February, 2017

Developers who build leasehold properties are selling the freehold to third party agents in order to make further profits – at the expense of the leaseholder. Many potential first-time buyers in the UK find it easy to ignore the difference between freehold and leasehold properties. And why not? Many leasehold homes enjoy a lease of […]

Continue reading >

Does London property face a stagnant future?

25 January, 2017

Between Brexit, the HS2 rail link and an ever-widening margin between property values and wages, affordable properties in the capital are a rarity – and times are getting tough for sellers. For decades, the London market has been a sound investment for potential homeowners, with phenomenal year-on-year value increases and high-paying jobs aplenty. Nevertheless, prior […]

Continue reading >

House prices continue to rise despite Brexit fears

18 January, 2017

The future looks rosy for some homeowners across the country, as house prices skyrocket due to property shortages, a low numbers of new-builds and low interest rates. But what about those in less popular locations? Fortunately, property buying companies like National Homebuyers are keener than ever to help achieve fast sales for everyone. It’s been […]

Continue reading >UK’s Plans A Truly Global Britain Via Brexit

The UK prime minister Theresa May has now outlined her a 12-point plan for leaving the European Union (EU), or the Plan for Britain, as she has called it. In her speech to diplomats at London’s Lancaster House, Theresa May for the first time revealed some key details about her approach to negotiations with the […]

Continue reading >Failure to innovate: Why traditional estate agencies are dying

11 January, 2017

For centuries, estate agencies have existed in one form or another – but in an increasingly digital world, more and more house selling professionals are finding themselves superfluous to requirements in the housing market. A mere 25 years ago, if you needed to sell your home, it would be unthinkable to go anywhere other than […]

Continue reading >London Property Slowdown Effects Estate Agents Profits

London’s property slowdown is having a detrimental effect on London estate agent Foxtons. Their revenue from selling houses has almost halved in the final quarter of 2016. Foxtons has announced that in the final quarter of last year they achieved a revenue of only £26m. This figure is down a quarter in the same period […]

Continue reading >Southern rail strikes hit house prices

10 January, 2017

Commuters are getting hit twofold by the ongoing Southern rail dispute. Not only are the recent rail strikes disrupting their journeys but now the strikes are actually having an effect on the value of their properties as well. According to eMoov, an online estate agent, house prices are growing slower around stations on Southern Rail […]

Continue reading >Why Do People Use Quick House Sale Companies?

There are numerous reasons as to why do people use quick house sale companies. These can include circumstances such as through divorce, retirement or the need to relocate. Perhaps they need to sell your property quick because you are close to losing your house due to financial difficulties. Or you might have inherited a property […]

Continue reading >

How will 2017 shape up for the housing market?

3 January, 2017

With a dramatic 12 months of turmoil within the industry finally over, can vendors and their prospective buyers afford to be optimistic for 2017? For the majority of people who hoped for a fast house sale in 2016, the year itself seemed to go from bad to worse, as uncertainty regarding the future of the […]

Continue reading >Looking back: The property market in 2016

28 December, 2016

With 2017 just around the corner, we take a brief look at the events that have affected the housing market and shaped one of the most eventful years in recent history. For many, 2016 is a year they would rather forget. With an inconceivable number of well-loved celebrities passing on, the UK voting to leave […]

Continue reading >Selling before Christmas – the best gift you can ask for

21 December, 2016

With the year drawing to a close, many hold off putting their house on the market – but if you do it right, it’s easy to stand out in the Christmas crowd. The property market is known to slow down in the run-up to Christmas, as the public turns its attention towards family gatherings, purchasing […]

Continue reading >UK house price growth will slow to 3% in 2017

The Royal Institution of Chartered Surveyors (RICS) housing forecast for 2017 predicts that house prices in the UK will see an average increase of 3% over the course of next year as the number of transactions stabilises. A year ago, the RICS predicted price rises of 6% and official figures are on track to meet […]

Continue reading >Badly planned new-build locations hindering industry progress

16 December, 2016

As fears continue to mount over the government’s ability to provide the necessary housing for a growing population, a new study has provided some insight as to why this issue is failing to be tackled in a practical manner. For many within the property industry, a key focus of 2016 has been the lack of […]

Continue reading >The Most Disgusting Properties in the UK

13 December, 2016

When you think of the most disgusting home ever then you would be forgiven for believing that this would be the forte of university students. Those people who have been to university will accept that this is actually something of an undeniable truth. A quick visit to a student property will present you with a […]

Continue reading >Are help-to-buy schemes harming the property market?

With the government implementing a number of proposals over recent years to incentivise property sales for first-time buyers, a top economist is alleging that these schemes are doing more harm than good. Over the last few years the government has introduced a range of policies, with the aim of helping those experiencing financial hardship to […]

Continue reading >Housing crisis creating more poverty-stricken families

8 December, 2016

As the government continues failing to act on the housing crisis, more and more working families are facing poverty, despite an economy that has continued to grow since 2010. It’s hard to believe sometimes that the UK, with its vast wealth and international influence, is facing a growing poverty crisis. With recent news of a […]

Continue reading >

Outlook for Scotland’s property market gets bleaker

6 December, 2016

After 18 months, the effectiveness of the LBTT scheme implemented by Hollyrood in April 2015 has started to come into question, with industry professionals warning that 2017 could bring suffering as a result. The changes to UK stamp duty made by George Osborne earlier in 2016 have been well documented in the media; and criticised […]

Continue reading >The Only Way is Essex – Brentwood Becomes The UK’s Top Property Hotspot

5 December, 2016

Brentwood has become the UK’s newest property hotspot. This town located in the county of Essex has a population of 49,463 and is most famous for the TV program The Only Way Is Essex. According to new research by buying agents Garrington Property Finders, using Land Registry data, house prices in Brentwood have risen 16% […]

Continue reading >Campaigners push for zero-carbon housing policy to be reinstated

2 December, 2016

With awareness on the increase about carbon-neutral housing, the government is being urged to reintroduce the policy which aimed to ensure all new-build homes are as efficient as common technology will allow. It’s not unusual for politicians to be voted into power based on promises they never intended to keep, and thereafter be hated by […]

Continue reading >

Broadband speed is a growing concern for vendors

29 November, 2016

As we move to online streaming from traditional broadcasting and favour online shopping over supermarkets, a fast broadband connection has become an important feature for potential homeowners – and therefore those wanting to sell to them. For decades, the term ‘location, location, location’ has been a key consideration for potential home buyers perusing properties on […]

Continue reading >New ban on letting agents charging fees to tenants

25 November, 2016

In his Autumn statement, the UK Chancellor of the Exchequer Philip Hammond announced a ban on letting agents charging fees to tenants. Letting fees – which are already banned in Scotland – are supposed to cover a range of administration, including reference, credit, and immigration checks. Mr. Hammond said shifting the cost to landlords will […]

Continue reading >

Remote Island with its own Napoleonic fort up for sale

A remote 19th Century Napoleonic fort off the Pembrokeshire coast in the UK has come onto the market for offer over £550,000 . This fort was originally built between 1852 and 1854 as one of three sea defences to protect Pembroke Dock from the French and was a hotel in the 1980s and 90s. The […]

Continue reading >As letting fees are finally banned, is this good news for the industry?

24 November, 2016

Letting fees have always been unpopular, but as the new Chancellor announces that he is planning to have them banned, property selling experts wonder whether this is actually good news or bad news for those stuck in the rent trap. The housing market can often seem unfair to those looking to buy their first house. […]

Continue reading >Property Lease Expiring Soon?

21 November, 2016

Why a Short Lease Could Prevent you from Selling Your House and Cost You More Money in the Long Run There are 1.43 million leasehold properties in the UK and many of their owners are unaware of the financial implications of their property’s shortening lease. Not a lot of people realise that a property’s value […]

Continue reading >

Are the Tories failing the UK housing market?

22 November, 2016