London’s property market finally starting to slow down

In London the median average salary is just £30,338 however if you wished to purchase a property in our country’s capital you will be looking at an average price tag of £522,000. House prices in London are almost actually three times the national average of £191,812.

This also means that London’s house prices are more than ten times peoples earnings. Wage growth in London is currently stagnant and isn’t keeping up with inflation and soaring house prices in the city.

The UK’s recent return to economic growth, high employment and persistently low interest rates, have all fuelled the growing house prices and to date it has been expected they will continue to rise relentlessly.

However in HSBC’s recent UK Housing Chartbook, the bank suggests that London’s soaring property market may actually be starting to slowdown.

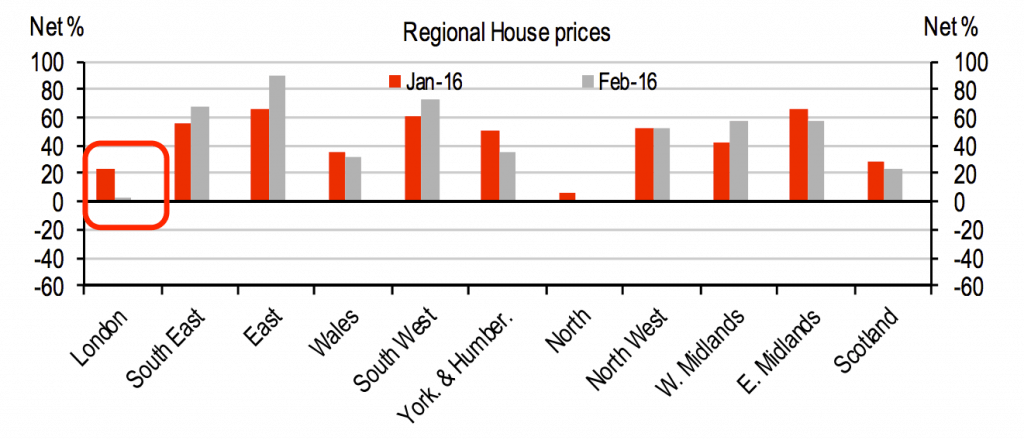

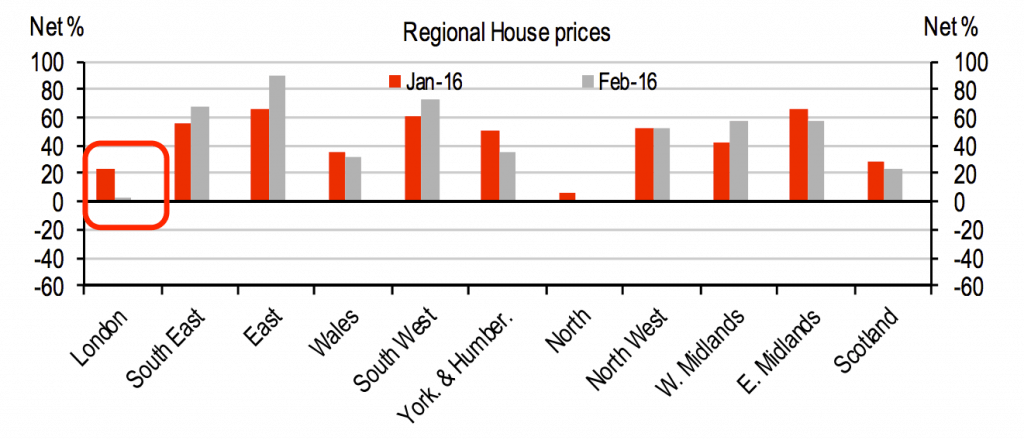

The chart below, taken from data compiled by the Royal Institute of Chartered Surveyors (RICS), shows that London ranked second to bottom when it came to price growth in February.

Source: RICS

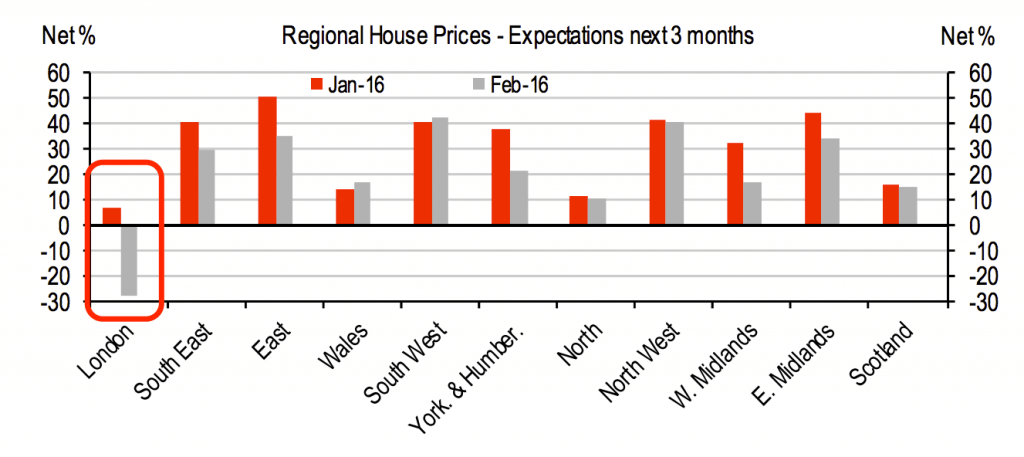

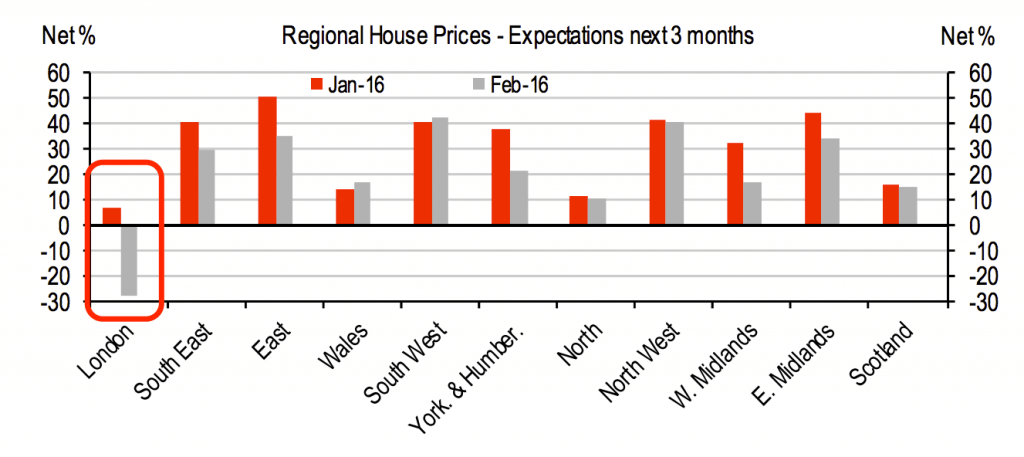

The next chart, also sourced from RICS, shows that most regions in the UK are expecting to see house prices grow over the next 3 months, London will actually see a big drop into negative territory.

Source: RICS

These charts, taken from HSBC’s report, show that London’s crazy rise in house prices is finally starting to lose its unstoppable momentum.

Rics chief economist, Simon Rubinsohn believes this drop in house prices in London will partially be the result of the UK’s introduction of an extra 3% tax on landlords and second home buyers.

Mr Rubinsohn said: “It is inevitable that over the coming months, April’s stamp duty changes will take a little of the heat out of the investor market.”

He went on to say “Anecdotal evidence suggests tax changes, concerns over Brexit and global economic uncertainty are all taking their toll on buyer sentiment in the capital.”

National Homebuyers – We Buy Any House

If you are looking to sell your house fast than we are here to help. Our team of property experts are always on hand to share their expertise with you and help you achieve your aim of selling your house fast in a time scale that suits you and not us. So if you want to sell your house fast than give us a call on 08000 443 911.

Get your no obligation instant cash offer now by clicking here – get offer