Now could be the perfect time to sell your home

It appears that the housing market has responded to last month’s surprise in the General Election. The Conservative’s victory appears to have stabilised the market. It is not all good news though with the need for more new-build homes becoming more and more pressing.

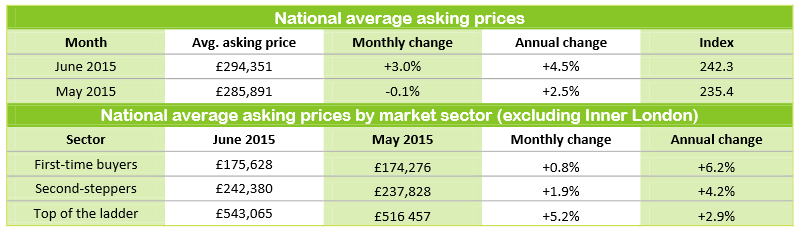

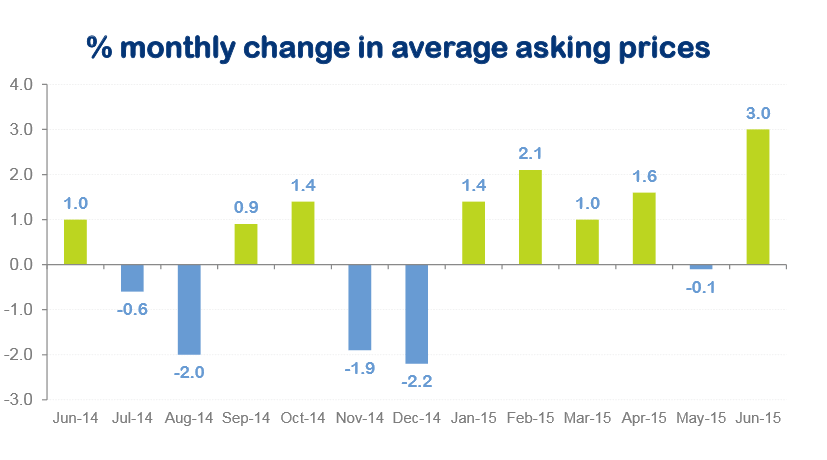

According to Rightmove, house prices have increased by an average of £8,460 after the uncertainty surrounding the political future of Britain came to a surprise conclusion. Few expected the Conservatives to achieve a majority and the prospect of a hung parliament meant that the market remained unstable and a stand-off ensued. The record increase in house prices has been evident in six out of ten regions as the imbalance of supply and demand begins to edge north. The average house price of property coming to market now stands at an unbelievable high of £294, 351.

There appears to have been an increase in buyer activity but sellers remain reluctant to join in the rigours of the property market. There is currently an unexpected reduced supply of property entering the market, down by 8.5% compared to the same period a year ago. However, there appears to be a substantial rise in the number of properties worth over £2million becoming available with an increase of 86% on a month-by-month basis.

Miles Shipside, Rightmove director commented: “Some buyers had been holding back in the weeks before the election, leading to some sellers suffering an unseasonal price standstill in the late Spring. In particular, sentiment and prices got hit in the mooted Mansion Tax price brackets. Now the unexpected election outcome has caused a strong rebound, prompting an upturn in buyer demand and helping new seller asking prices to hit their highest ever levels.”

The previous asking price record was set in April of this year at £286,133, which was £8,218 below this month’s record. Rightmove’s May index fell by 0.1% and was attributed to uncertainty surround the General Election.

This is evidenced in the fact that six out of ten regions have recorded new record price-highs this month as the imbalance of supply and demand continues to head north. The consequence of this is that the average house price is in fact increasing further and further up the north of the country. Along with the four southern regions, the East & West Midlands both recorded all-time-price-highs this month.

Peter Woodthorpe, Director of Readings in Leicester, commented: “While we’ve had even more prospective buyers come into the market after the election we haven’t seen an increase on the supply side. The demand has been strong from people looking for all types of property, from flats to large detached houses, and it’s not just in the sought after locations. Over the past year house prices in the area have increased by around 10% or so, so it’s not surprising to us that this month sees a new asking price record in the East Midlands.”

It won’t come as a surprise but London has seen the strongest monthly price performance and has increased by 5.7%, driven by the fact that more and more top-end owners are willing to enter the market now that Mansion Tax has been removed from the equation.

Alex Bourne, Director at Hanover West End, remarked: We were holding a few instructions back before the election, one example being a £10, 500, 000 house in Knightsbridge that we marketed the other day after the election and agreed a sale on within a week of instruction. We also went live with a number of other properties over the £2m price range straight after the election and noticed a change in the appetite of buyers at that level. We received enquiries from much more committed buyers and have generated several offers over the £2M mark since the election. There is still a difference between sellers’ expectations and the price buyers are willing to pay, but sellers are becoming more realistic with the price they are willing to accept despite listing at record prices per square foot. We’ve agreed a number of sales between £5 and £15 million, significantly less than the asking price. I believe the lull before the election motivated the sellers and simply the thought of what a mansion tax might do to the market has created a situation where they are willing to deal at a more realistic price.”

It appears that there are numerous reasons to be optimistic about the UK property market, especially those who are looking to buy or sell at the top-end of the market. There is, however, a pressing concern which appears to be growing month by month. The current reluctance that sellers are displaying means that that there is a real and substantiated need for new and affordable housing to be built across the UK. At the moment it appears that the UK could potentially be heading towards the European trend of renting property with families passing property down within the family to combat the difficulty of getting on the first rung of the housing market.