New Help to Buy ISA aims to help first time buyers

How does a Help to Buy ISA work

The Help to Buy Individual Savings Account (ISA) was unveiled by the UK Chancellor George Osborne in the government’s 2015 budget and was officially launched on 1st December 2015

Help to Buy ISAs are a new type of ISA designed to help first-time buyers save up a deposit to help them buy their first home.

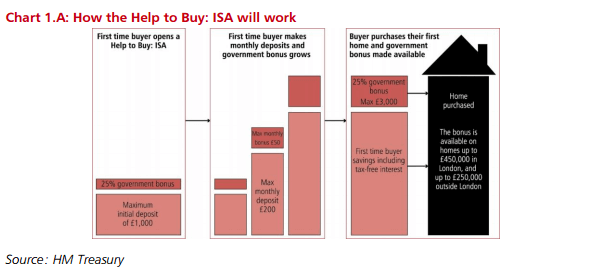

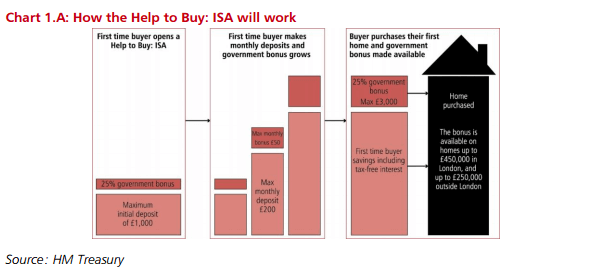

The Help to buy ISA works by allowing you to place your house deposits savings into an ISA account and the government will boost your savings by 25%. For example if you was to place £200 into your Help to Buy ISA then you will receive a government bonus of £50. However there is a restriction because the maximum government bonus you can receive for a Help to Buy ISA is £3,000 which is tax free.

The rule is that the Help to Buy ISAs are available to each individual first-time buyer, not each house brought, so if you’re buying a property with your partner, you’ll be able to get up to a maximum of £6,000 tax free capital towards your deposit. The Help to Buy ISA can also be used with any mortgage; you’re not restricted to a Help to Buy mortgage.

Source : Experian

Since the recent launch of the Help to Buy scheme there are already 14 providers that have launched Help to Buy ISAs, with interest rates as high as 4%.

To qualify for a Help to Buy: ISA you must:

- You need to be a first-time buyer.

- You must be aged 16 or over.

- You must be a UK resident with a valid National Insurance number.

- You must not have another active cash ISA in the same tax year: If you have opened a cash ISA this tax year, you can open a Help to Buy: ISA but will have to take additional steps.

To qualify for the government bonus, you must:

- Buy any home worth under £250,000 (or under £450,000 in London).

- Not intend on renting out the property.

- Not be a second home or a buy-to-let property

- Not use the Help to Buy ISA on overseas property.

How does the bonus get paid on a Help to Buy ISA?

- Save up for your mortgage deposit using a Help to Buy ISA.

- When you’re ready to buy your first home, close the account.

- You’ll then receive a closing letter from the ISA manager.

- Give the closing letter to your property solicitor or conveyancer.

- They will use the letter to apply for your government bonus.

- The bonus is transferred to your solicitor. They’ll then complete the purchase of your home using the full bonus amount.

Drawbacks of the Help to Buy ISA

The idea of a Help to Buy ISA designed to help first-time buyers save for a deposit to get them on the property ladder is an excellent one in theory however in practice there are a few potential drawbacks.

One suggested drawback is that these ISAs will slow down the housing market over the next few years because first-time buyers will delay purchasing their first home until they can benefit from the maximum government bonus of £3000 they can achieve by waiting.

This exposes another drawback which is the fact that with a Help to Buy ISA you can only save a maximum of £200 a month, which makes saving for your deposit a very slow process. In fact it could take up to five years of paying £200 a month before you could claim the full £3,000 bonus which is a very long time frame.

Another drawback is the fact that the amount you can save with a Help to Buy ISA is a lot less than a regular ISA, because with a regular ISA you can pay up to £15,240 in a tax year.

This exposes another drawback because you are not allowed to open two ISAs in the same tax year: so if you’ve already opened an ISA this tax year, you’ll have to wait until April 6, 2016, to open a Help to Buy ISA

Also this Help to Buy ISA will increase first-time buyers which in term will cause property prices to increase, making this new scheme potentially self-defeating.

Plus a lot of people are not able benefit from this scheme because you cannot open a Help to Buy ISA if you’ve already been on the property ladder in the past. This even applies to people who no longer own their homes, you simply cannot open one of these accounts if you previously owned your home under any circumstance.

Another drawback is the fact that the government bonus can only be used to buy a home, you cannot use it for anything else. Well you still have access to your money and its normal interest, but if you choose to use the money for anything else or you withdraw the money then you forfeit the opportunity to get the bonus payment.

National Homebuyers – We Buy Any House

National Homebuyers are a UK based property buyer who really do buy any house or property! In fact we will buy anything, absolutely anything! Whether it is a house, flat or bungalow we will buy it!

If you are looking for a fast house sale then we are here to help you. Our team of property experts are always on hand to share their expertise with you and help you achieve you aim of selling your house fast in a time scale that suits you and not us. So if you want a sell house fast service then give us a call on 08000 443 911.

Get your no obligation cash offer now by using the Get Offer on the right-hand side of this page and take the hassle out of selling your home!