How to sell a house during the COVID-19 Lockdown

After over a decade of uncertainty stemming from the financial crisis in 2007, the property market was slowly beginning to show signs of recovery at the start of 2020. During February, not only were mortgage approval levels at record highs, but there had been over 70,000 sale completions1 – with many more buyers applying for a mortgage with hopes of purchasing in the near future.

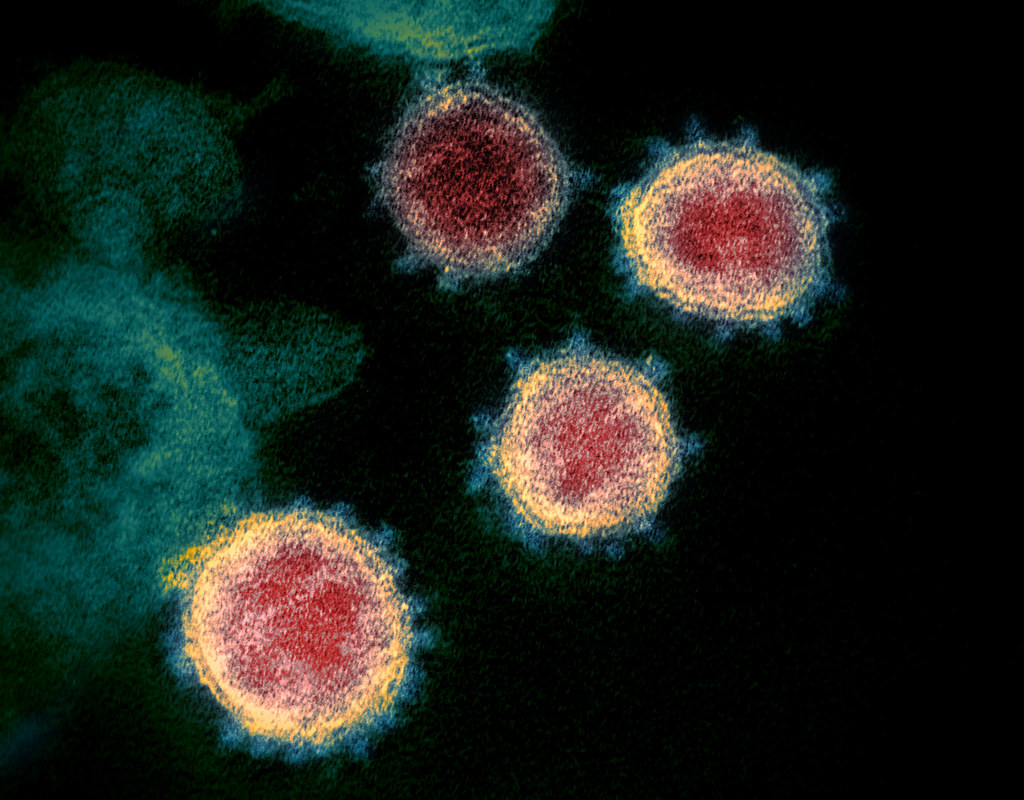

Unfortunately, as March approached, news began to appear that the coronavirus outbreak that started in Wuhan, China back in November 2019 had failed to be contained and had quietly spread widely across the entire civilised world2.

With a high transmission rate, the virus has led to an economic slowdown the likes of which have never been seen before, with France, Spain, Italy, the UK and many more European countries beginning a systemic nationwide lockdown that enforced social distancing and self-isolating in an effort to slowdown the proliferation of the virus.

Those who were hoping to sell their house, therefore, have had their hopes of completing a sale and being able to purchase another utterly dashed.

Government rules regarding house sales during the coronavirus lockdown

The UK government has not currently enacted any emergency laws that could prevent a house sale from taking place, but make it clear that you would be placing yourself and others at risk if you were to do so when the move could have been delayed3.

Current guidelines state that both sellers and buyers should discuss the best way to approach the situation, with many industry professionals urging sellers to discuss the matter directly with their estate agent in an effort to delay the completion date3.

If a move cannot be delayed, for example if a chain of purchases have gone through that require you to vacate you property by a certain date for the sake of a new owner/tenant, then moving house is allowed but those involved in the physical move should take precautions such as remaining two metres apart from one another, and using masks and gloves whenever possible3.

Is it worth trying to sell a house during the coronavirus lockdown?

This is all dependent upon your personal situation. There are many people who will need to sell for reasons such as an inability to pay their mortgage, or to cover the costs of losses to their businesses during the lockdown phase. It is important to not, however, that as it is unlikely to sell as fast as it would during normal market conditions, you may eventually be forced to lower the asking price considerably in order to encourage a sale in a period when very few buyers are looking to actually buy, and that asking price may have to fall further once the lockdown is over to compensate for the length of time is has been on the market with a sale.

It is clear, then, that the odds of gaining a fast house sale during the lockdown are very slim. Of course, there are other options such as housing-buying companies who are able to buy a house for cash in a single payment – forgoing the stress often associated with the traditional house-buying process. Companies such as these will buy any home – regardless of condition or situation, providing the seller with capital that they can put towards a new home.

What if my mortgage offer or completion date expires before the lockdown ends?

As mentioned previously, nobody is barred from moving home during lockdown, but this requires all relevant parties to figuratively be on the same page. If the residents of the house you are supposed to be buying are unable or unwilling to move during the lockdown you may find yourself worrying that your mortgage offer (which would usually last for three months) is due to expire before you are able to complete the transaction.

Luckily, Finance UK has instructed all UK lenders and banks to allow customers in such a delicate situation to extend their mortgage offer deadline by a further three months4, and to offer extensive support to those who need it – especially first time buyers, who may be less than savvy regarding the house buying process.

I want to sell and buy a new home now while interest rates are low, would I miss out if I don’t?

As with any period of financial and economic uncertainty, the Bank of England have slashed interest rates5, allowing lenders to offer fantastic mortgage deals that normally would be out of reach. During the coronavirus, however, many lenders are not accepting any new applications5. This is because they want to know that their client will have the ability to afford the monthly repayments – and as many of these people may be out of a job, or at least earn substantially less for the foreseeable future, it is easy to see why6.

It is important to remember that interest rates will not immediately jump back up to pre-COVID-19 levels as many potential house-buyers fear, so those who are in a strong financial position should be able to get an excellent mortgage rate, but for the majority of average earners, it is likely that banks will be using stricter lending rules for the foreseeable future.

The best advice for those in such a position, is it make preparations for a house sale as you would normally and gather all proof of earnings ready so that once the lockdown has been fully lifted, you will have everything you need to start the process.

If I can afford to wait to sell, should I?

If moving house is a matter of urgency for the sake of money, a new job or to free up capital, then few would blame you for pushing for a sale during the lockdown – and as mentioned earlier, there are always house-buying companies to help you in these situations. However, it is extremely likely that house prices will begin to fall substantially over the next few months as demand continues to dry up, and for that reason, those who can afford to wait 12 months are likely to see not only an increased demand for their home, but also higher sales values7.

Are you looking to sell your home during the COVID-19 lockdown? Why not ask National Homebuyers for advice, as we buy any house. Call 08000 443 911 or request a call back to find out how much you could get for your property before it’s too late.

References:

- 1 Hughes, K. (2020). How to move house during an outbreak. Available: https://www.independent.co.uk/money/spend-save/how-move-house-coronavirus-sell-buy-rent-lockdown-restrictions-removals-closed-a9437121.html. Last accessed 24th April 2020.

- 2 Davidson, H. (2020). This article is more than 1 month old First Covid-19 case happened in November, China government records show – report. Available: https://www.theguardian.com/world/2020/mar/13/first-covid-19-case-happened-in-november-china-government-records-show-report. Last accessed 24th April 2020.

- 3 Ministry of Housing, Communities & Local Government. (2020). Government advice on home moving during the coronavirus (COVID-19) outbreak. Available: https://www.gov.uk/guidance/government-advice-on-home-moving-during-the-coronavirus-covid-19-outbreak. Last accessed 24th April 2020.

- 4 Sproson, K. (2020). Home movers impacted by coronavirus to be offered mortgage extensions by lenders. Available: https://www.moneysavingexpert.com/news/2020/03/homemovers-impacted-by-coronavirus-to-be-offered-mortgage-extens/. Last accessed 24th April 2020.

- 5 Clark, D. (2020). Mortgage rates fall but mortgage lenders withdraw products. Available: https://moneyfacts.co.uk/news/mortgages/mortgage-rates-fall-but-mortgage-lenders-withdraw-products/. Last accessed 24th Apr 2020.

- 6 Collinson, P. (2020). After coronavirus: ‘We can’t go back to business as usual’. Available: https://www.theguardian.com/money/2020/apr/04/coronavirus-business-finance-work-property. Last accessed 24th April 2020.

- 7 Abgarian, A. (2020). Is now a good time to buy or sell property? Available: https://metro.co.uk/2020/04/20/now-good-time-buy-sell-house-12581050/. Last accessed 24th April 2020.