Thousands to lose mortgage support benefit from April 2018

As a result of continued efforts by the government to reduce the national debt, many are finding that it is those living in low-income households who are bearing the brunt of the austerity measures.

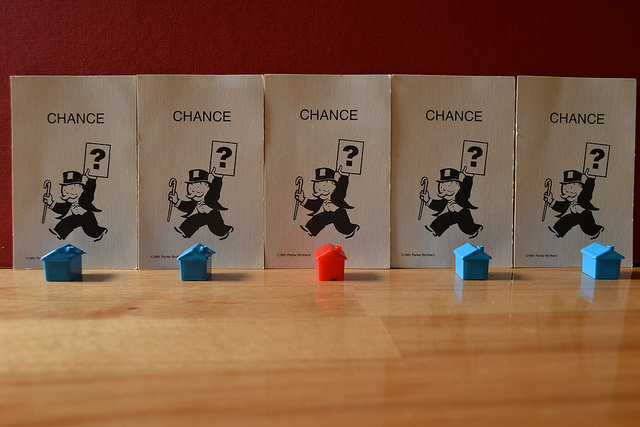

Since 1948, those who own a house but struggle to keep up with their mortgage payments have always had a lifeline – the Support for Mortgage Interest scheme. Introduced to prevent thousands of low-income households from losing their homes, the SMI has been a godsend for many older people who, today, still rely on it to ensure that they can keep a roof over their heads.

Thanks to favourable interest terms and a strong economy during the 1960s and 1970s, many buyers took the option of an interest-only mortgage rather than a repayment-based equivalent due to the minimal monthly repayments. But what once appeared to be a sensible idea is, today, beginning to look like a bad decision.

The Tories, in an effort to reduce the national debt, have decided that from April 2018, this benefit will be axed – replaced by the opportunity to take out a ‘loan’ from the government that must be paid back upon sale or relinquishment of ownership.

Consequently, many experts have pointed out that those who need the SMI scheme are hardly in a position to afford a further repayment plan on top of their own mortgage – a mortgage they are already having trouble finding the funds for.

Across the UK, there are currently 124,000 individuals who rely on the benefit, with over half of those in retirement age. This situation is partially due to the fact that pension credit is one of the qualifying criteria for the scheme. However, it isn’t just the retired population who are going to be affected, as many people on income support, as well as those on jobseeker’s allowance will also find their safety net removed in four months’ time.

The government have stated that the current status quo is unsustainable, and that because the repayments will not need to be made until the properties in question are sold or passed on to another individual, it will not have a great effect on those who need the loan in the short-term. Unfortunately, many industry experts are worried that thanks to the addition of interest rates to these ‘loans’, the government will be profiting from those who are most at risk of losing their homes.

“The government needs to make sure people have the help and advice they need to decide whether or not to take out a second mortgage to pay for this,” claimed a spokesperson from mutual insurer Royal London.

“But instead, thousands of people are getting letters that miss crucial details such as the interest rate on the mortgage.”

This situation, combined with the government’s plan to remove the ability of those on the Universal Credit scheme from using their benefits as proof of earnings when applying for a mortgage on a home of any value, it appears that those from low-income backgrounds may be forced into renting for life, which will ultimately reduce the number of people who can afford to buy a home from an owner who needs to sell their house fast.

No offers on your home? Why not ask National Homebuyers for advice, as we buy any house. Call 08000 443 911 or request a call back to find out how much you could get for your property.